U.S. Physician Groups Market Size and Trends

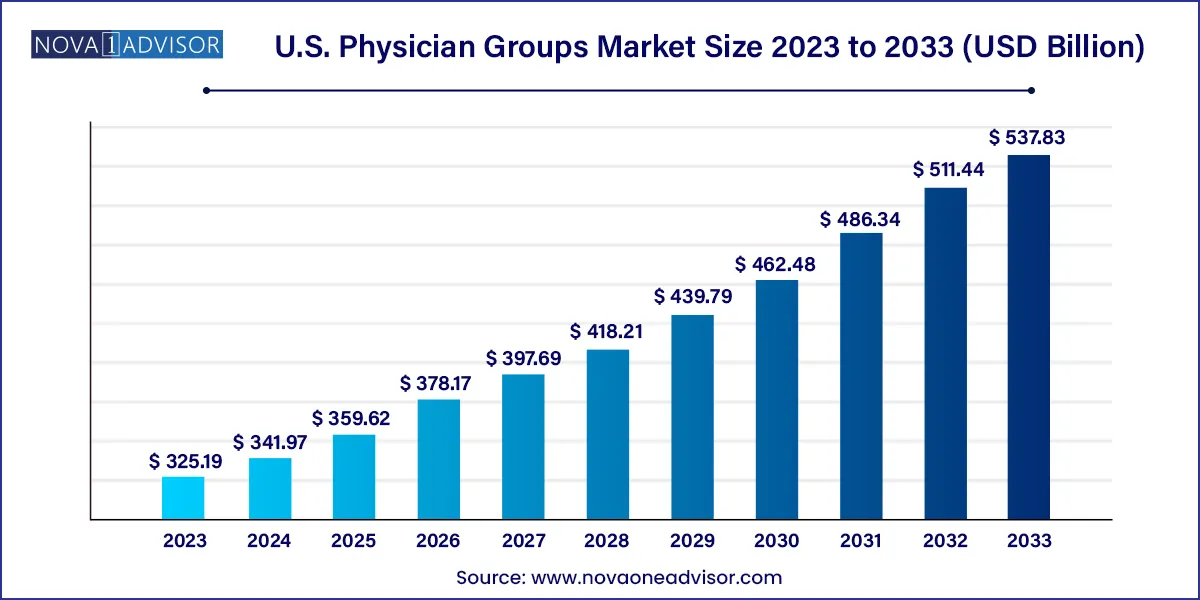

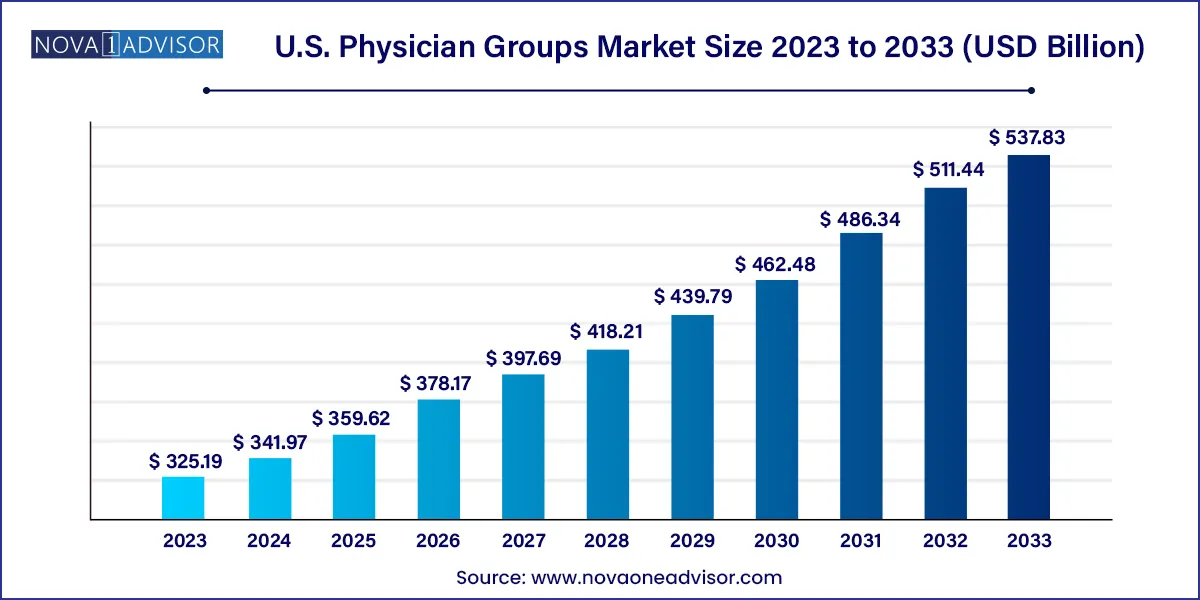

The U.S. physician groups market size was estimated at USD 325.19 billion in 2023 and is projected to hit around USD 537.83 billion by 2033, growing at a CAGR of 5.16% during the forecast period from 2024 to 2033.

U.S. Physician Groups Market Key Takeaways

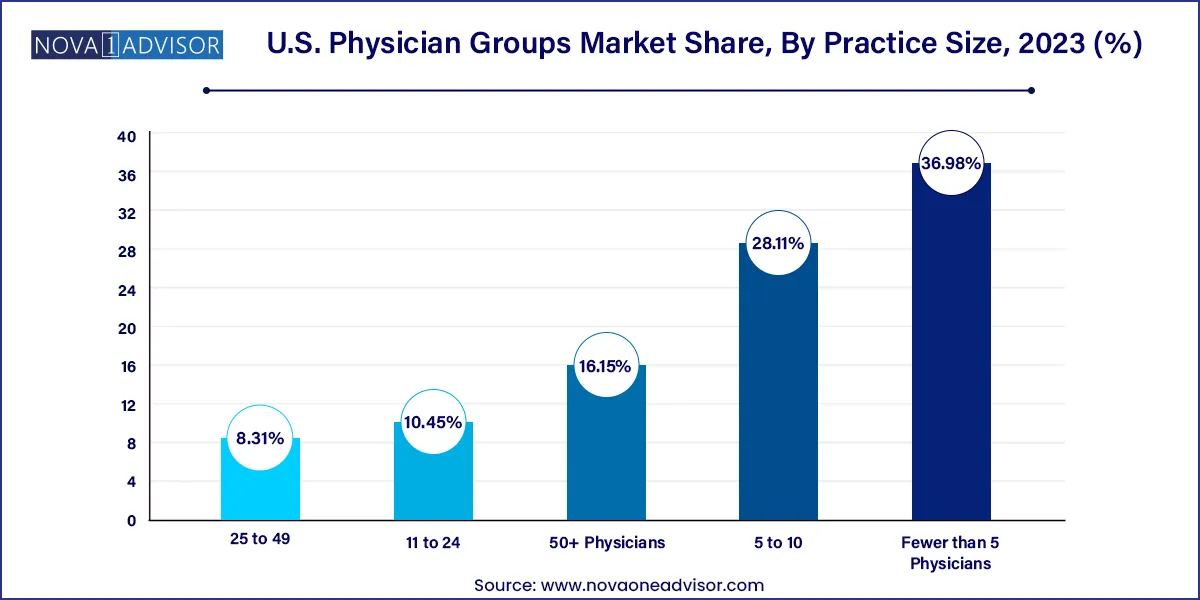

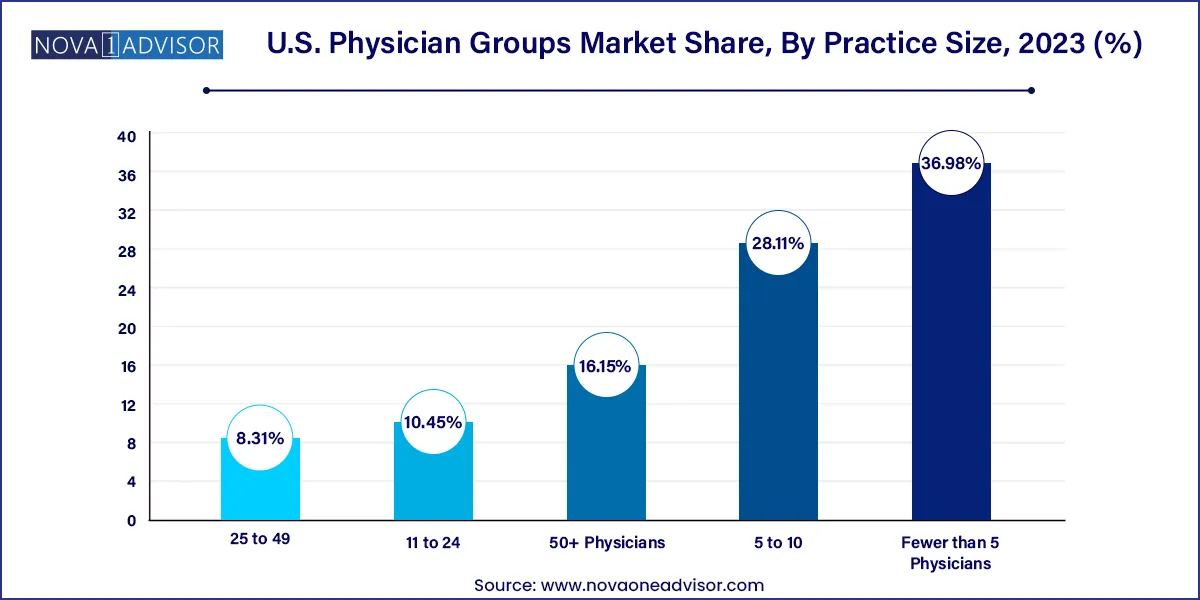

- In 2023, the fewer than five physicians segment dominated with the largest revenue share of 36.98%.

- The 50+ physicians’ segment is expected to witness the fastest CAGR over the forecast period.

- The single specialty group segment dominated with a revenue share of 61.1% in 2023.

- The multi-specialty group segment is anticipated to grow at the fastest CAGR from 2024 to 2033.

- The physician-owned segment held the largest market share of 49.89% in 2023.

- The private equity segment is expected to grow at the fastest CAGR from 2024 to 2033.

- The Southeast U.S. dominated the market in 2023 with a revenue share of 25.84%.

- The West U.S. is expected to grow at the fastest CAGR during the forecast period.

Market Overview

The U.S. physician groups market represents a cornerstone of the American healthcare delivery system, acting as the primary point of care for millions of patients annually. Physician groups ranging from small, independently-run clinics to large, multi-specialty conglomerates serve as a critical link between patients and the broader healthcare infrastructure, including hospitals, insurers, and government programs. Their evolving structure is reflective of the shifts in healthcare policies, economic pressures, technological advancements, and changing patient expectations.

Historically dominated by solo or small practices, the market has undergone a significant transformation over the past two decades, with a marked shift toward larger, consolidated physician groups. This trend has been largely driven by regulatory pressures, increasing administrative burdens, and the need for robust IT infrastructure to comply with electronic health record (EHR) mandates and value-based care initiatives. As of 2025, physician groups are increasingly characterized by their integration with hospital systems, growing investment from private equity firms, and emphasis on specialty services that promise higher margins and patient retention.

The U.S. market has shown substantial growth, driven by rising chronic disease prevalence, increased healthcare utilization among aging populations, and government policy shifts favoring group practices over fragmented care. According to recent estimates, nearly 70% of physicians in the U.S. are now affiliated with larger practices, either hospital-owned or investor-backed, as these entities provide better financial stability and administrative support.

Moreover, technology adoption, particularly telemedicine, AI diagnostics, and practice management software, has significantly influenced operational efficiency and patient engagement. With mounting pressures to reduce costs while improving outcomes, physician groups are strategically aligning to create integrated networks that can deliver coordinated, patient-centric care especially vital in managing long-term conditions such as diabetes, hypertension, and mental health disorders.

Major Trends in the Market

-

Consolidation and M&A Activity: Private equity and hospital systems are aggressively acquiring small physician practices to create integrated delivery networks.

-

Rise of Value-Based Care: Physician groups are transitioning from fee-for-service to value-based models, rewarding better outcomes and patient satisfaction.

-

Technology Integration: Adoption of advanced EHR systems, AI-powered diagnostics, remote monitoring, and virtual care platforms is reshaping practice operations.

-

Specialization Focus: There’s a growing inclination toward specialty practices such as cardiology, dermatology, and orthopedics for higher ROI and niche patient markets.

-

Physician Burnout & Staffing Shortages: Administrative overload and workforce fatigue are pushing providers toward joining larger, better-supported groups.

-

Private Equity Penetration: Significant capital is flowing into healthcare, with firms actively investing in dermatology, ophthalmology, and primary care segments.

-

Regulatory Pressures: Compliance with HIPAA, MACRA, and other regulatory frameworks continues to push smaller practices toward consolidation or partnership.

-

Consumer-Centric Services: Enhanced focus on digital health portals, mobile scheduling, and patient satisfaction is steering practice design and services.

-

Urban vs. Rural Disparities: Urban regions see higher saturation of multi-specialty groups while rural areas remain underserved, offering growth potential.

-

Growth of Concierge and Subscription-Based Practices: High-income demographics are driving demand for direct-pay models and personalized services.

U.S. Physician Groups Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 341.97 Billion |

| Market Size by 2033 |

USD 537.83 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.16% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Practice type, practice size, ownership, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Cleveland Clinic; The Permanente Medical Group; Optum, Inc.; Select Physical Therapy; HCA Florida Healthcare Physicians (HCA, Inc.); University of Pittsburgh Physicians (UPMC Physicians); NYU Langone Health Physicians (NYC University Physicians Network); Northwestern Medical Group (Northwestern Medicine); HealthCare Partners IPA (HealthCare Partners, MSO); Northwell Health Physician Partners (Northwell Health); RWJBarnabas Health Medical Group; Ascension; Penn Medicine Physicians (The Trustees of the University of Pennsylvania) |

Key Market Driver: Shift to Value-Based Care

One of the most significant drivers shaping the U.S. physician groups market is the shift from fee-for-service to value-based care (VBC). This transition, strongly supported by Centers for Medicare & Medicaid Services (CMS), emphasizes outcome-driven compensation, rewarding physicians for efficiency, preventive care, and positive patient outcomes rather than volume of services rendered.

This change has fundamentally altered how physician groups are structured and operated. Multi-specialty and hospital-owned practices have an edge in adapting to VBC due to access to resources, integrated health IT systems, and care coordination capabilities. The result is a rise in Accountable Care Organizations (ACOs), patient-centered medical homes, and risk-sharing arrangements, all requiring robust group collaboration and data management.

For example, One Medical a membership-based, technology-enabled primary care provider has excelled in implementing VBC by integrating digital tools, predictive analytics, and preventive care strategies, reducing unnecessary hospital admissions and improving patient satisfaction. Such examples demonstrate how value-based care is not only a regulatory mandate but a viable business model reshaping physician group success.

Key Market Restraint: Physician Burnout and Workforce Shortage

Despite growth prospects, the U.S. physician groups market is heavily constrained by increasing physician burnout and workforce shortages. High patient volumes, administrative duties, insurance paperwork, and EHR documentation contribute to professional fatigue and early retirements.

According to a 2024 American Medical Association (AMA) survey, more than 60% of physicians reported signs of burnout, especially in primary care and emergency medicine. This challenge is compounded by an aging physician workforce and insufficient medical school graduates to replace retirees, particularly in rural areas.

The result is a competitive recruitment environment, high turnover costs, and increased reliance on nurse practitioners and physician assistants. Although large groups may offer better work-life balance and support systems, smaller practices struggle to retain talent, limiting their sustainability and contributing to market consolidation.

Key Market Opportunity: Telehealth Expansion and Hybrid Models

Telehealth has emerged as a transformational opportunity for physician groups, with its potential to broaden access, reduce operational costs, and enhance patient satisfaction. The COVID-19 pandemic accelerated the adoption of virtual care, and it remains a preferred model for many patients seeking convenience and accessibility.

Physician groups integrating hybrid care combining in-person and virtual services are better positioned to attract tech-savvy patients and offer extended reach, particularly in underserved regions. Specialties like psychiatry, dermatology, and primary care have seen the highest telehealth utilization.

For instance, in 2024, VillageMD (backed by Walgreens) announced further investments in expanding hybrid primary care clinics across the U.S., with digital follow-ups and remote chronic care management. This reflects how physician groups embracing telehealth platforms and AI-driven diagnostics can scale faster, enhance care continuity, and stay competitive.

U.S. Physician Groups Market By Practice Size Insights

Physician groups with 50+ physicians currently dominate the market, backed by their infrastructure, administrative efficiency, and technological sophistication. These groups typically have access to advanced practice management tools, internal referral networks, and better bargaining power with payers. Their ability to deploy robust EHR systems, hire specialized non-clinical staff, and operate satellite clinics contributes to consistent revenue generation and scalability. Hospital-affiliated and PE-backed groups often fall into this category, enhancing their ability to attract new physicians and negotiate favorable insurance contracts.

Simultaneously, groups with 11 to 24 physicians are the fastest growing, particularly among independent and physician-owned entities. These medium-sized practices strike a balance between flexibility and efficiency, making them ideal for regional operations and specialty-focused care. Their size allows for collaborative clinical decision-making without the bureaucratic layers found in large hospital systems. These groups are also agile in adopting niche telemedicine services, concierge care, and direct-to-employer models, particularly in suburban and exurban areas where larger players have limited presence.

U.S. Physician Groups Market By Practice Type Insights

Multi-specialty groups dominated the U.S. physician groups market in 2024 due to their capacity to provide integrated care, optimize resource use, and cater to diverse patient needs. These groups offer better clinical coordination, especially in chronic disease management where comorbidities require input from multiple specialties. Multi-specialty models also benefit from economies of scale and are better suited for value-based reimbursement frameworks. The presence of in-house diagnostic labs, pharmacy services, and rehab units makes them attractive to insurers and health systems looking for efficient care pathways.

In contrast, single-specialty groups are witnessing rapid growth, particularly in dermatology, ophthalmology, and anesthesiology. These specialties offer high margins, shorter procedure times, and growing demand due to aesthetic medicine trends and an aging population. Dermatology groups, for example, are drawing investor interest as demand for cosmetic and outpatient surgical procedures continues to grow. Furthermore, surgical specialty practices are leveraging ambulatory surgical centers (ASCs) to perform procedures at lower costs than hospitals, fueling the rise of focused single-specialty groups.

U.S. Physician Groups Market By Ownership Insights

Hospital-owned physician groups currently lead the U.S. market due to integrated service offerings, institutional backing, and consistent patient referrals. These groups enjoy preferential access to inpatient services, diagnostics, and pharmacy networks, allowing for seamless patient experiences. Hospitals also provide back-office support, easing administrative burdens and ensuring compliance with Medicare reporting and billing standards. Furthermore, hospital ownership is often linked with participation in bundled payment programs and government initiatives such as ACOs, aligning with long-term care improvement goals.

However, private equity (PE)-owned groups are the fastest growing ownership category in the U.S. market. PE firms are particularly active in acquiring specialty practices like ophthalmology, cardiology, and orthopedic surgery. Their strategy revolves around operational optimization, brand consolidation, and regional expansion through add-on acquisitions. A notable example is the 2023 acquisition of several cardiology clinics by Varsity Healthcare Partners to form a national cardiovascular platform. The scalability, growth capital, and exit potential make PE ownership attractive to physician entrepreneurs looking to grow or retire.

Country-Level Analysis

In the U.S., the physician groups landscape is heterogeneous across states. Urban and coastal states like California, New York, and Massachusetts have high concentrations of large, multi-specialty groups affiliated with academic health systems and integrated networks. These regions benefit from strong payer-provider coordination, advanced digital infrastructure, and policy incentives supporting collaborative care.

In contrast, southern and midwestern states such as Mississippi, Arkansas, and Kentucky face physician shortages and higher dependency on small, physician-owned practices. These markets offer growth potential for telehealth services and investor-backed expansions. Rural and semi-urban areas continue to lack specialty services, driving interest in mobile clinics, virtual diagnostics, and nurse-led community care centers.

Texas and Florida stand out for their rapid growth in PE activity in specialty practices—dermatology, orthopedics, and ophthalmology fueled by affluent populations and high demand for elective procedures. Furthermore, Medicare Advantage penetration is highest in states like Florida, influencing group practices to adapt risk-sharing payment models.

U.S. Physician Groups Market By Recent Developments

-

March 2025: Privia Health Group announced a new joint venture with a major health system in Georgia to establish a multi-specialty physician group network aimed at value-based care expansion.

-

February 2025: VillageMD, backed by Walgreens Boots Alliance, opened 25 new primary care locations integrated with pharmacies across the Midwest, emphasizing hybrid care models.

-

January 2025: Cardiovascular Associates of America acquired multiple cardiology clinics in Arizona and Nevada, expanding its specialty footprint and enhancing referral networks.

-

December 2024: UnitedHealth Group’s Optum division acquired a large multispecialty physician group in Texas, reinforcing its vertically integrated care strategy.

-

November 2024: TPG-backed Skin & Aesthetic Centers expanded into Colorado and Utah by acquiring dermatology practices, reflecting rising interest in cosmetic outpatient services.

U.S. Physician Groups Market Top Key Companies:

- Cleveland Clinic

- The Permanente Medical Group, Inc.

- Optum, Inc.

- Select Physical Therapy (Division of Select Medical)

- C-HCA, Inc. (HCA Florida Healthcare Physicians (HCA, Inc.))

- University of Pittsburgh Physicians (UPMC Physicians)

- NYU Langone Hospitals

- Northwestern Medical Group (Northwestern Medicine)

- HealthCare Partners IPA (HealthCare Partners, MSO)

- Northwell Health Physician Partners (Northwell Health)

- RWJ Barnabas Health Medical Group

- Ascension

- Penn Medicine Physicians (The Trustees of the University of Pennsylvania)

U.S. Physician Groups Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Physician Groups market.

By Practice Type

- Single Specialty Group

- Primary Care

- OB/GYN

- Ophthalmology

- Surgical

- Psychiatry

- Cardiology

- Anesthesiology

- Dermatology

- Radiology

- Emergency Medicine

- Others

- Multi-specialty Group

- Primary Care

- OB/GYN

- Ophthalmology

- SurgicalPsychiatry

- Cardiology

- Anesthesiology

- Dermatology

- Radiology

- Emergency Medicine

- Others

By Practice Size

- Fewer than 5 Physicians

- 5 to 10

- 11 to 24

- 25 to 49

- 50+ Physicians

By Ownership

- Physician-owned

- Hospital-owned

- Private Equity-owned

- Others

By Regional

- Northeast

- Southeast

- Southwest

- Midwest

- West